Are you tired of being turned down for funding because of a shaky credit history or the complete lack of one? Do you dislike applying for funding because of the extensive application process and mass amounts of paperwork? Speak with us about our stated income commercial real estate funding today.

Stated income funding can be used for any number of reasons, including improving property, purchasing property, consolidating debt, building working capital and refinancing. To decide whether this type of funding is ideal for your business, consider the following:

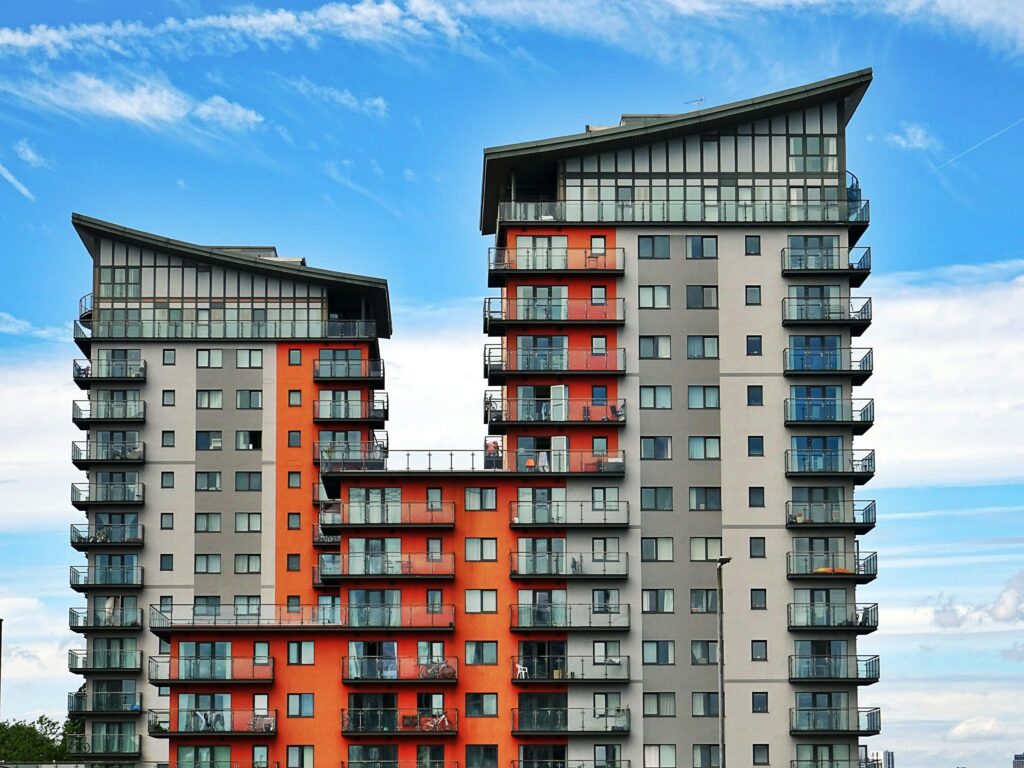

Stated income funding differs from a traditional funding in that when you apply, lenders look toward the value of the property in question as opposed to your credit history. The value of the property must be able to cover the mortgage, insurance and taxes of the loan. Because the only documentation you need to provide when applying is the property assessment, approval for stated income funding typically happens much more quickly than it does with traditional funding.

To succeed in your industry, you need the right funding. Get in touch with us to begin the fast and easy pre-qualification process for your stated income funding today so you can grow your company.